The purpose of the GAO Report was to look at: trends, pros and cons, data limitations and regulation of third party litigation financing. The report supports a number of propositions that Augusta, and many others in the funding market, have been making for a number of years: third party funding is a useful tool to realise value, transfer risk and increase access to justice.

The report considered that third-party litigation funding generally falls into two categories: (i) commercial funding; and (ii) consumer funding. It made the distinction between an arrangement where a funder agrees to provide funding for legal or business expenses (often in the millions of dollars) in exchange for a portion of the award. This is in the event of success as ‘commercial funding’ on the one hand, and an arrangement between a funder and an individual plaintiff. For example, in a personal injury case, where the funder provides smaller amounts for living expenses, often under USD10,000.

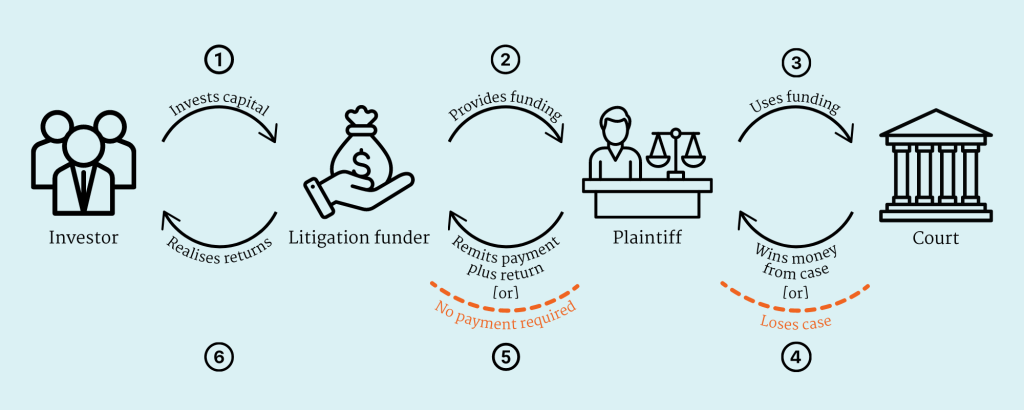

The graphic below summarises the relationship between investors, funders, plaintiffs and the Court:

Source: GAO. | GAO-23-105210

The GAO Report identified a number of advantages of third party funding for both commercial and consumer funding. It noted that third party funding helps even the playing field for underfunded plaintiffs. This is the access to justice or ‘David and Goliath’ point that funding can allow smaller parties with less direct access to capital take on well-capitalised, larger organisations (often multi-national corporations), where they might otherwise be unable to spend the time.

Two other advantages identified in the GAO Report were the ability to monetise claims and the ability to transfer risk to a third party. These benefits apply to all parties. Claimants can convert their claims to cash, and bring that cash forward, thereby realising the value of those claims today, rather than waiting for the outcome of litigation. This applies whether the claimant raises cash against the claim, or frees up cash that would otherwise be used to fund the litigation. In addition to this cash benefit, transferring risk to a third party allows claimants to offload some of the downside risk, and the non-recourse nature of funding means that in no scenario will the claimant be liable for its costs.

For commercial users of third party funding, the report also pointed to the benefits of due diligence that a funder will conduct in assessing the merits of a case, which allows the claimant to receive an assessment of the strengths and weaknesses of cases from funders analysis.

In terms of trends, the GAO Report noted that the commercial funding market has grown in recent years as businesses have become more familiar with it as a concept, with growth in the US market being observed across the board over the last 5 years. This manifested in the volume of funding advancing, but also an increase in the number of requests for funding, as well as new funders entering the market.

On the investor side, the report pointed to market data, which marked an increase in capital from investors to new deals of 11% in 2021. This growth has come alongside an increased acceptance and use of funding, with all funders responding to the report that litigation financing had grown in acceptance in recent years. This has also seen law firms and corporates both looking to innovative structures in legal finance.

To conclude, the GAO Report serves as a useful guide for those unfamiliar with litigation funding, with its application and insights reflecting our experience globally, not just in the US.

At Augusta, we are focused on providing liquidity, sharing risk and assisting clients drive value through our innovative funding solutions and welcome the conclusions of the GAO Report. We also look forward to assisting with the growth and continued maturity of the industry in the coming years.

…

This article was written by Sean McGuiness. For all questions regarding the topics raised in this article, please contact Sean or a member of our team of litigation funding experts.